#Masterworks – The only investment platform dedicated to art investing

https://masterworks.art/mhfin

Invest in blue-chip art for the very first time. Purchase shares in great masterpieces from artists like Picasso, Warhol, and more!

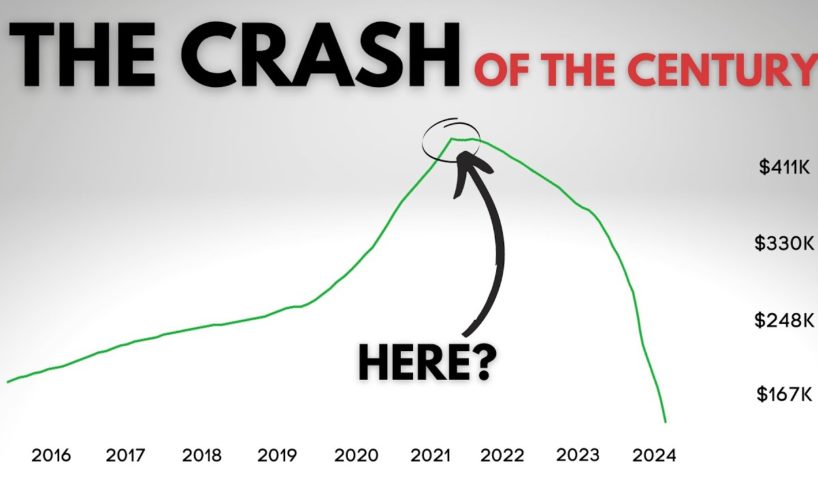

Everything You Need To Know About The Incoming Housing Crash

The US housing market. After years of demise and slow growth following the 2008 recession real estate is back in the headlines. The median home price today stands at a record-breaking $413,000. Alongside this price appreciation, mortgage rates have recently pushed past 5%. These conditions have created a hectic market, where non-cash buyers are on average paying over $2200 a month for their mortgages, almost 30% higher than last year. For many affording a home has simply become impossible. The big question is on everyone’s mind. When is this bubble going to pop?

0:00 – 1:31 Intro – How Bad Is It Out There

1:32 – 3:12 Masterworks.IO

3:13 – 4:13 Where are Prices Going in 2022

4:14 – 5:16 Active Listing (Inventory Crisis)

5:17 – 7:48 Why I Could Be Wrong

7:48 – 8:57 Are We Headed Towards Diaster

9:07 – 9:26 Outro

source

#Masterworks – The only investment platform dedicated to art investing

https://masterworks.art/mhfin

Laguna Hills, CA Housing Prices Crater 27% YOY As Mortgage Defaults Ripple Across Southern California

Worse case house market drops 20%

The wisest thing that should be on everyone's mind currently should be to invest in different streams of income that doesn't depend on the govt. Especially with the current economic crisis around the world, this is still a good time to invest in, crypto currencies (BTC, ETH, XRP……..)

Successful people don’t become that way overnight. what most people see at a glance wealth, a great career, purpose is the result of hard work and hustle over time. I we be forever grateful🙏🏻 to Mia Frank Investment.

24 years old figuring out my place in this world looking for a career that can financially set my foundation. Times are tough but I’m willing to fight for my wife and I to get us this little piece of the American dream… we are humbled through Christ and we can do anything with him in our hearts.

Maybe folks just have to face the thought of moving to another area where homes are more reasonable. Hint: Try OLD Bullhead City, Arizona. Seriously, you have the Colorado River a mere walking distance away, with nine gambling casinos on the river bank across the river in Laughlin, Nevada, you have four-wheeling in the Black mts. (where gold mines are STILL being mined to this day). Fireworks over the river on the 4th of July is a sight to see. And we’re only 90 miles south of Vegas. Water taxi’s move people from one casino to the other, for those who don’t drive. There’s plenty of water sports (fishing, jet skies, etc.) and the best Springtime in the nation. Most important, PRICES ARE STILL REASONABLE.

It’s hard to take a channel seriously when they base their entire video around a paid sponsor …. Shame on you

I think there are still some wealthy, cash handy people who can buy up these homes currently, and they are. Home are selling quick and at a record pace in my neighborhood (Austin). However, I think they will start to dry up later this year. Based on everything I'm now seeing, I think a crash will happen, but it may not really happen for another year or two; that's where these YouTuber's get it wrong. Not that it will happen, but when it will happen.

One difference between now and the 80s is QT and we'll see that experiment commence in two weeks.

Good clickbait video. Today's RE market is so incomparable to the 1980s this video is laughable even at the most basic levels!

Build.

#BuildBackBigger, most communities need to cut all restrictions on building single family homes.

Worked in RE for a few years. IMO, biggest flaw I see with pricing of RE is comps. If a certain number of houses with relatively the same age and square footage of living space sell in a given time frame at similar prices, that doesn't mean the house down the street of the same age and sq. footage should/will bring the same price. Location and overall condition of a property can and will add or subtract to a property's market price.

House listed in my neighborhood for 399K, sign never went in the yard and sold for 501k.

In the 80s home prices were not as high as they are now. Back then you could get a house for 100K, 20K down, mortgage high in relation to salaries but salaries back then were keeping up. Today's housing market is different story. In some markets like San Digo CA the average home price is close to 800K, 160K down, the mortgage being above 40% of salary. We are going to hit 7% home interest rates this year, I wouldn't be surprised if we hit 8%. On top of that we have inflation, a war, high energy prices. This will definitely bring a correction.

Glad I stumbled upon this, I've come by articles and videos of people that grew a $200K to $800K in just months, what do you guys think they invested in and how can one outperform the market and make such profit.

I'm up in Canada and the Chinese have completely destroyed our housing market. Instead of $413,000 where I live the average price is more than $1,413,000 not for detached homes but for all homes including apartments and townhouses. New detached homes start around the 3 million dollar mark. I'm white but live in Markham, Canada.

If investment firms are buying homes the interest is meaningless. Is there any data around what type of buyers are actually buying homes right now? Is the % of total home sales trending toward more investment firms?

You do get Taxed 28%

I would rather put my money in life insurance at this point. Hold down multiple remote jobs to increase income as well. Time to think differently

All these videos made for views about a crash that isn’t going to happen

100k for a single wide….200k for a double…. what a joke

Interesting opinions and date. Only opinion i would add, in the 80’s I believe income growth was what pushed the inflation up. In todays environment inflation/prices are rising faster then wages. On the credit comment, up until recently it wasn’t easy to track credit score, thus historically credit scores are up interested to see where things go from here

So you are saying you dont see a crash

BS!!

Has the Fed raised rates? They keep talking about it, but so far. The fed chair must have all their money in Gold.

Golden, CO Housing Prices Crater 24% YOY As Sellers Slash Double Digits Across Denver Area

I think you missed the part where housing prices have grown at a rate much faster than consumer income has. The debt to credit ratio for the mortgages now are substantially higher than they were for those back in the last recession. An 18% mortgage rate today would annihilate the middle class purchasing power. Only the investors would be able to swoop in and purchase the homes all out. I’m not sure the ratio of home sales of investors vs live in home owners. But I can assure you it’s skewing the numbers today.

8:20 you are looking at an extended range. If you only look at early 80s DURING recession, then prices not so good. What you ARE saying is time IN market beats timing the market, which I do agree with.

You said nothing about all the homes that the government kept from getting the market those places are gone these people gonna be homeless and those homes are gonna flood the market

As long as housing prices continue cratering, all is well.

San Diego, CA Housing Prices Crater 12% YOY As Inventory Soars Triple Digits

It's really important that channels like yours that have a large audience and lean a little bearish are brutally honest about the reality of the situation. Then people can at least make informed decisions. Right now the people who don't own are clinging to 2008 2.0 out of sheer hope, and hope is not a strategy. The reality is we don't have enough homes. Period. So people are going to have to make cuts elsewhere in their budgets to land one. I've been preaching this since I got on YT 2 years ago, and the numbers/math suggests this is at least another 10 year run in home prices. The demographics are simply too strong, and we have a massive Gen Z in the pipeline…could even be a 20 year bull market from here, which seems absurd, but Australia is in year 27 of their housing bull market due to similar forces and just had a 24% increase last year…

Rising interest rates will make the supply problems worse. Nobody will want to sell their current home with a 3% interest rate when their next mortgage will be 6% or higher.

New home construction was down, during the pandemic. We are see the effects on supply via the slow down in New postings. When the new construction posting hit the market. The market will stabilize after the market stabilizes. A large number of people will be upside-down in thier home and there will be the crash. Everyone is trying to justify their emotional financial decisions during the pandemic reality will sink eventually.

I would humbly suggest to put household affordability and savings into account when comparing with the history data. The American may not afford a large house anymore.

If there were only some way to decrease the population we could solve this housing supply shortage problem. My colleagues at the WEF and CDC are going to put their heads together to see if there is anything we can do to make that happen. Perhaps, some type of vaccine that destroys the reproductive system is in order?

MHFIN bought the top of the housing bubble and is in denial

“I’m just a YouTuber with no real estate experience”.

You missed a key point. Today both husband and wife work. In the early 1980s many families were single income and thus could absorb the rising costs with having second person start working.

You forgot about cost of living is higher then ever before and house prices. Can't sustain. People will choose food over mortgage when it comes down to it.

Inventory is low, but with high interest rates companies like Blackrock will stop investing in homes for rent. This will open up a lot of supply. Also population growth in 2021 was the lowest since 1930’s a crash is coming, and it isn’t too far away imo.

This whole things is a house of cards. If just one thing happens the whole thing is coming down. Interest rate stock market crash the failure of the us dollar world war. Are we really ready for any one of those let alone multiple events.